The Fear&Greed Index is a key indicator that helps investors gauge market sentiment by analyzing various factors that influence stock or cryptocurrency markets. It measures whether investors are feeling fearful or greedy at a given time, which can impact market movements significantly.

How the Fear&Greed Index Works

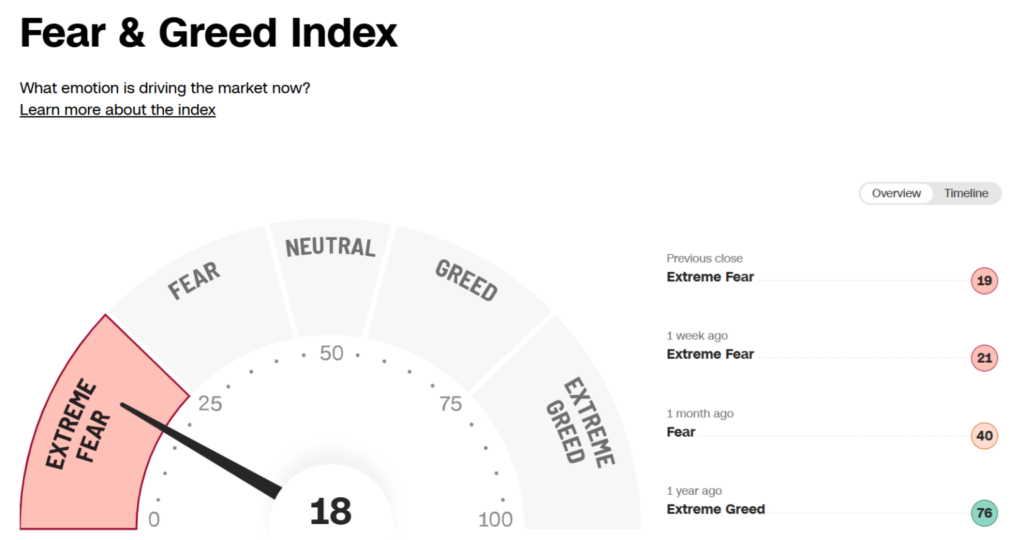

The index ranges from 0 to 100:

• 0-24 (Extreme Fear): Investors are highly fearful, which may indicate a buying opportunity.

• 25-49 (Fear): A generally pessimistic market outlook.

• 50-74 (Greed): Investors are optimistic, and the market is in an uptrend.

• 75-100 (Extreme Greed): The market is overheated, and a correction might be imminent.

Factors That Influence the Index

The index is typically calculated based on multiple market indicators, such as:

1. Market Volatility: Increased volatility can indicate fear.

2. Momentum & Price Strength: A strong uptrend suggests greed.

3. Put/Call Options Ratio: More put options may indicate fear, while more call options suggest greed.

4. Market Breadth: Measures whether stock prices are moving in unison.

5. Safe Haven Demand: High demand for gold or bonds suggests fear.

6. Social Media & News Sentiment: Positive or negative headlines influence investor emotions.

Why Is It Important?

• Helps Identify Market Trends: Investors can use the index to gauge whether the market is overbought or oversold.

• Supports Contrarian Strategies: Some traders buy when fear is high and sell when greed dominates.

• Prevents Emotional Investing: Understanding market sentiment can help investors make rational decisions rather than acting on emotions.

Conclusion

The Fear & Greed Index is a valuable tool for analyzing market sentiment. While it shouldn’t be the sole factor in investment decisions, it provides useful insights into whether the market is driven by fear or greed, helping investors navigate volatile conditions more effectively.